What is loss aversion?

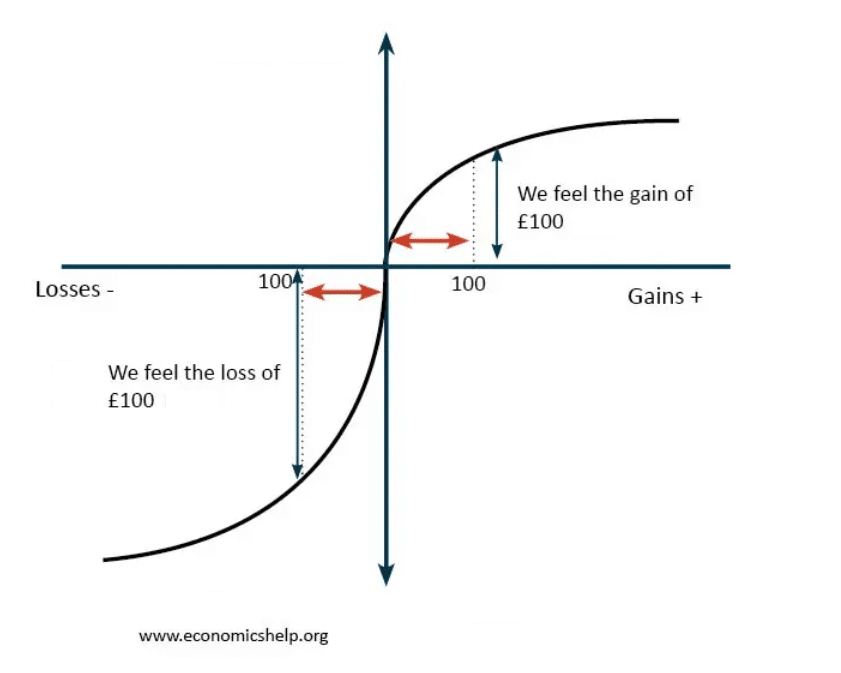

Loss aversion is a common behavioral bias. Research suggests that the pain of losing is twice as powerful as the pleasure of gaining. The chart below shows that the feeling for losing 100 dollars/pounds is twice as strong as gaining 100 dollars/pounds. In behavioral finance, this is also known as the Prospect Theory.

Many of us have experienced moments when we wanted to take a chance but hesitated, even when the potential rewards were attractive. This common scenario often stems from psychological factors influencing decision-making, known as ‘loss aversion.’ Loss aversion can impact choices in various aspects of life, leading individuals to prefer avoiding losses over acquiring equivalent gains.

At the heart of risk aversion lies the principle related to loss aversion, which suggests that the pain of losing is psychologically more impactful than the pleasure of gaining. The bias could influence our finances, health, relationships, etc.

Loss aversion in everyday life will be evidenced in many ways. For example, one may hold on to some lousy work instead of getting a new opportunity, fearing the uncertainties that come with changes. Humans would also likely avoid facing certain hard facts or hard decisions insofar as doing so would expose them to some risks.

Understanding loss aversion isn’t avoiding the risks altogether; it’s recognizing how the fear of loss can impact a decision. Realizing this bias allows us to strive for more informed choices that strike a balance between potential risks and rewards.

To help clients overcome loss aversion, advisors can combine conversations about loss aversion with deep analytics to show the risk and return of short, medium, and long-term investment portfolios. This approach provides clients with a clearer understanding of the potential outcomes of their investment decisions, helping them to make more informed choices.

One of the possible best practices is to use the Risk Tolerance Plus flow as a priority-first flow and give the client the Loss Aversion Questionnaire at the next possible occasion. This tool helps the client to know their risk tolerance levels, and in doing so, it really provides the advisor with a lot of insight into how investment strategies for his clients should be customized.

Financial advisors then become much needed to advise them on the loss aversion problem where human beings prefer very much to avoid losses than to acquire equivalent gains. The advisor helps the client become more sensitized to such biases and what they imply in making more informed decisions. This knowledge empowers the client, grants permission, and establishes confidence to consider a bigger range of options and approach the opportunity for loss more equally. At last, this is, in truth, education and guidance that empowers advisors to help their clients to rise above the restrictions of loss aversion into decisions congruent with the long-term financial good of the client.

The market turmoil during the COVID-19 is a perfect example. When S&P 500 lost 30% in early 2020, the fear and pain was extremely strong. But the level of joy when S&P 500 gained 30% in 2019 was nowhere nearly as strong, nor when the market recovered strongly later in 2020.

A common trait shared by amateurs and professional investors, it is deeply rooted in our survival instinct. While gaining is nice, losing food etc. can threaten the survival of an animal.

In fact, rogue traders are more often the result of loss aversion than evil. It often starts with a small loss, and in an effort to cover it up, the trader would double down and take more risk, digging a bigger and bigger hole for themselves.

Loss aversion assessment

Loss aversion can be assessed using this mini questionnaire, which is adapted from the research literature. It has only two questions:

Q1: Out of the two options below, which one do you prefer?

A. 100% chance of gaining $2000.

B. 75% chance of gaining $4000; 25% chance of gaining nothing.

Q2: You are then presented with another set of two options below. Which one do you prefer?

A. 100% chance of losing $2000.

B. 50% chance of losing $5000; 50% chance of losing nothing.

For the first question, a rational investor would choose B, because the expected gain in B is $3000, much higher than the gain in A, while the risk is relatively small. If an investor chooses A, it indicates the tendency to secure gain, a form of loss aversion, because they can’t bear the pain of the 20% chance of getting nothing.

The second question is even more painful to decide. People’s gut reaction is often, “I want neither.” But sometimes we do face a decision like this. For example, a gambler has lost $2000. Would he accept the loss, or doubling down in an effort to win it back? This is how gamblers end up digging a deeper hole for themselves. Rogue traders, who lose hundreds of millions of dollars for their firm, often started out with a much smaller loss, but instead of accepting the loss, they would double down, and dig a deeper and deeper hole for themselves. Doubling down is another form of loss aversion.

The table below summarizes the mapping:

| Answer to question 1 | Answer to question 2 | Has loss aversion? |

|---|---|---|

| A | B | Yes |

| B | A | No |

| A | A | Some (Secure gain) |

| B | B | Some (Double down) |

How to use loss aversion assessment?

Loss aversion is a common behavioral bias, and most people have it. Make sure you tell clients that, and that you have it too if you follow your heart (if this is true), so they don’t feel bad. The point is to have this awareness, that the level of panic is not an accurate reflection of the reality, and they can cut it by half.

This is most powerful when you combine the conversation on loss aversion with deep analytics to show the risk and return of the short, medium, and long term of their portfolios.

Since the Risk Tolerance Plus flow is the first priority, we recommend you give the loss aversion questionnaire to your client at the next opportunity.

Having this awareness helps clients put their emotions in perspective. Knowing that the emotion is not an accurate gauge of the reality helps to prevent irrational investment decisions.

Quick Links

Back to AccuProfile™

- 2D Risk Tolerance Assessment

- From risk tolerance to proposal generation

- Investor Type

- Behavioral biases: Loss Aversion, Overconfidence, Herding

- Protecting aging clients: Cognitive Ability Test

- Financial IQ

- Describe Yourself

- Behavioral Risk Index

Copyright © 2022. Andes Wealth Technologies. All rights reserved.