Transform Investment Distribution

“We have solved the investment problem. It is time to solve the investor problem.” — Industry expert

Transform Investment Distribution

“We have solved the investment problem. It is time to solve the investor problem.” — Industry expert

Solving the Investor Problem is the New Frontier

Investment products are increasingly commoditized.

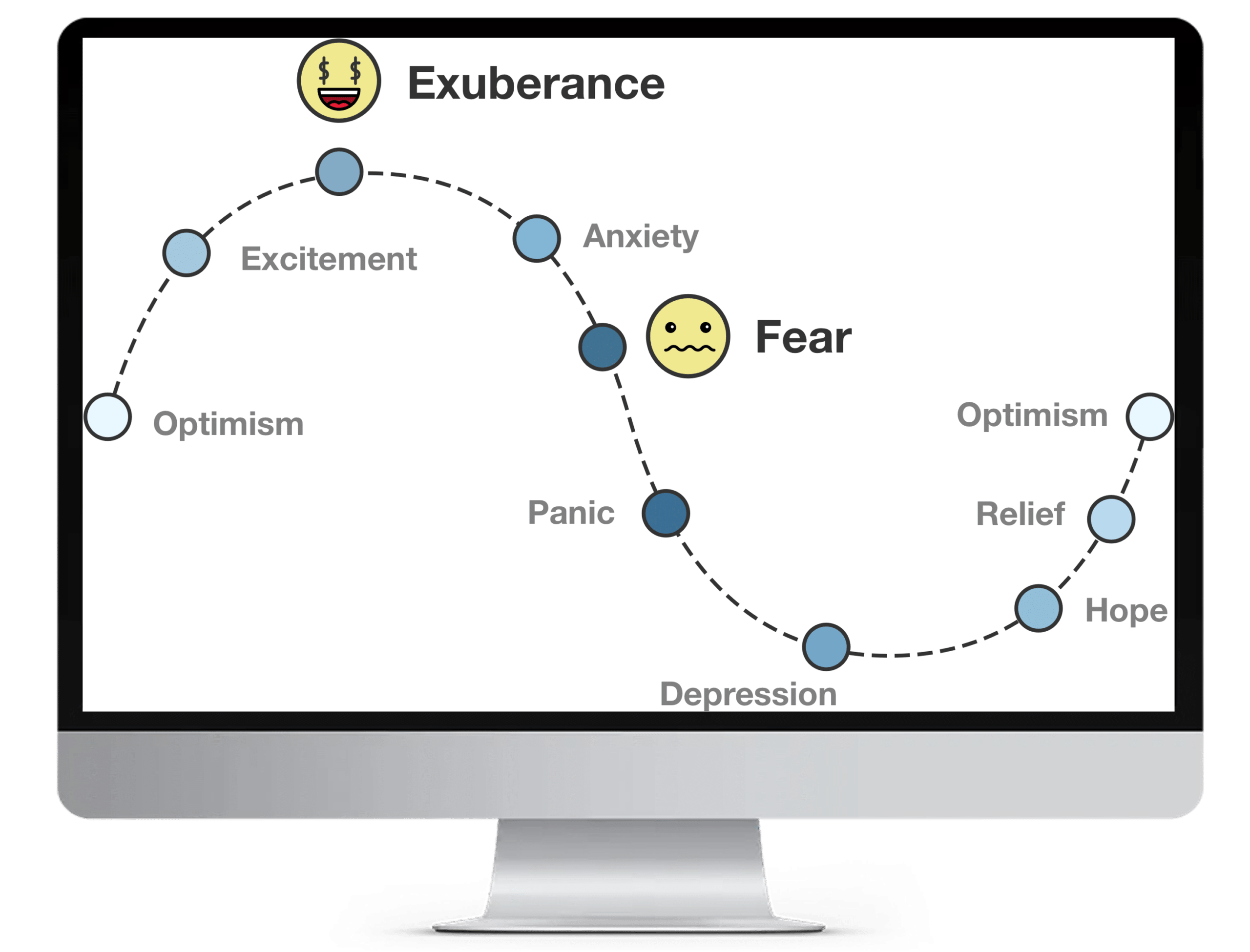

Solving the investor problem is the new frontier. Human minds err, systematically and consistently, when forced to make judgments in uncertain situations.

Asset managers are uniquely positioned to take the lead, because you have the scale, distribution, and incentive.

But how to solve the investor problem?

Andes Comes to the Rescue

Inspired by the groundbreaking theory by Dr. Andrew Lo from MIT, Andes Wealth embeds behavioral finance throughout its integrated risk and client onboarding platform to help financial advisors solve the investor problem.

If you incorporate Andes Wealth as part of your offering to financial advisors, you will have a holistic solution for both investments and investors.

Too Much Transparency?

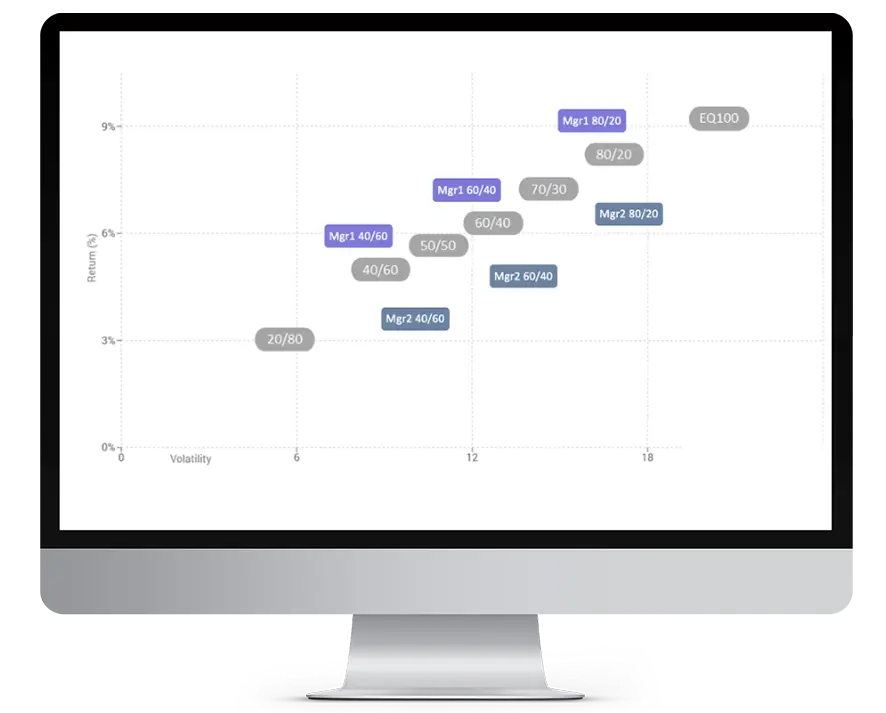

Our patented deep analytics delivers unprecedented clarity and transparency to strengthen trust throughout the ecosystem.

Is this too much transparency? Maybe, but it is the transparency that financial advisors and investors deserve and will come to expect.

FOR MODEL MANAGERS

If you are a model manager, the chart can help you visually identify financial advisors with low performing models to better target your sales effort.

More importantly, you can demonstrate it interactively in the sales process, comparing the risk and return of any market condition by adjusting the time period and end date below.

FOR FUND MANAGERS

If you are a fund manager, use the same step above to quickly identify financial advisors with low performing models. You can construct a set of models using your funds as the de-facto efficient frontier as the reference point for comparison.

Next, Andes’ fund comparison tool visually compares funds in your models versus advisor’s models, so you can easily demonstrate why your funds are better than the funds in their models.

FOR MODEL MARKETPLACE

Model marketplaces typically provide a fact sheet for each model. There is no visual way to easily compare the models.

Using our deep analytics, you can enhance advisors’ “shopping experience” by allowing them to compare many models on one page, providing much needed clarity and transparency.

Want to learn more? Submit the form to get in touch today.