AccuProfile®: Actionable Behavioral Finance

AccuProfile®:

Actionable Behavioral Finance

Why Is Behavioral Finance Important?

A widely cited Vanguard study quantifies an advisor’s value to be 300 basis points, out of which behavioral coaching contributes up to 200 basis points.

However, Morningstar research suggests that investors don’t want to be coached. This shouldn’t be a surprise. Just recall your own teenage years – did you want advice?

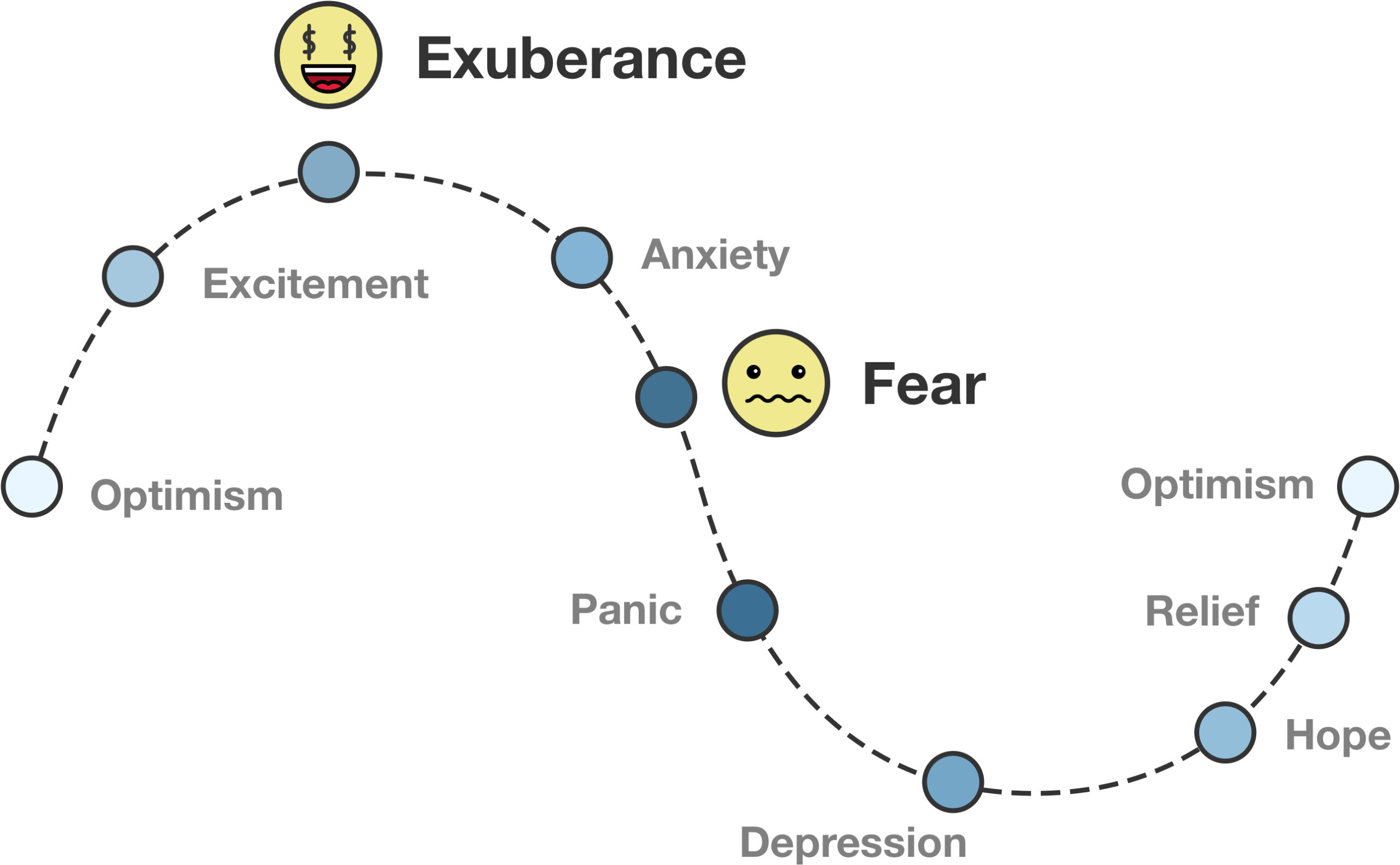

But clearly, investors, like teenagers, can be driven by emotions and make irrational decisions at times. Can we make behavioral finance palatable and enjoyable?

How to Make Behavioral Finance Easy to Use?

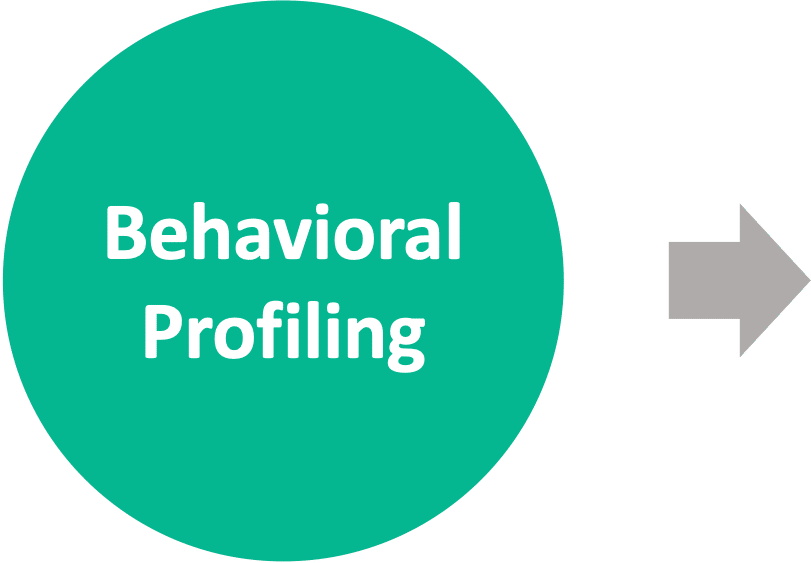

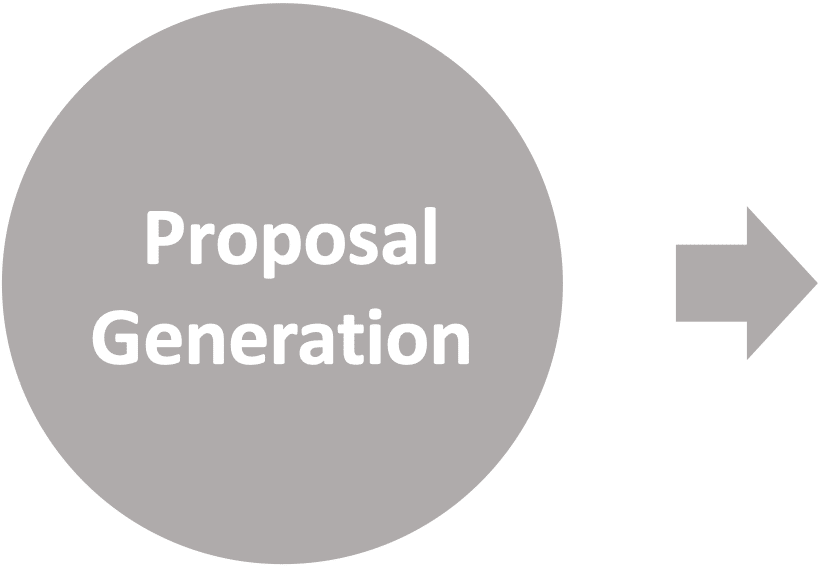

Just like how our DNA is composed of various genetic markers, behavioral finance can be dissected into numerous behavioral factors. These factors, akin to DNA markers, contribute to the intricate tapestry of human decision-making and financial behaviors.

Similar to genetic markers, each behavioral factor can be independently assessed, and then you can put them together for the big picture.

What Behavioral Factors Are Most Relevant?

Here are some of the most important behavioral factors that are directly relevant to wealth management:

- Investor type: How do you respond to market ups and downs? Are you a passive investor, trend follower, or contrarian?

- Behavioral biases: The most commonly known behavioral biases include loss aversion, overconfidence, herding, the confirmation bias, and the recency bias.

- Financial IQ: How much does your client know about finance and investing?

How to Quantify Investor Behavioral Risk?

Just as investments have investment risk, investors have behavioral risk.

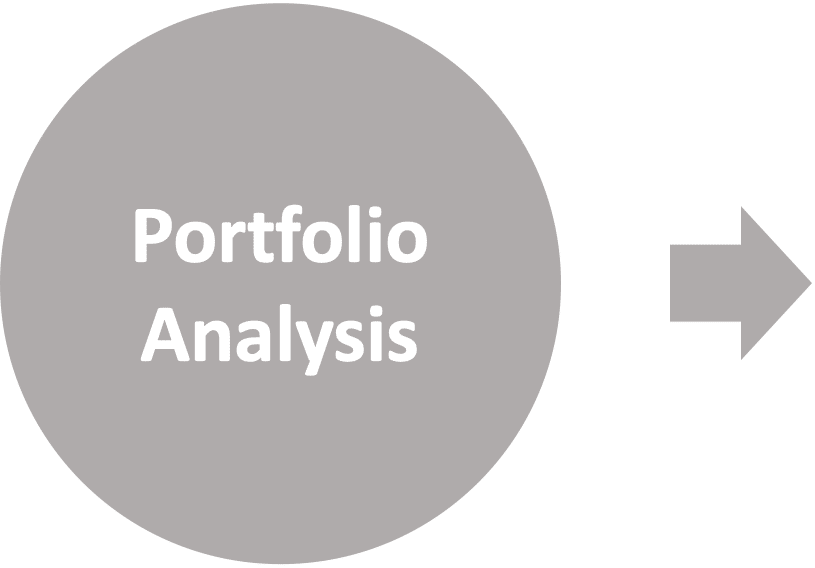

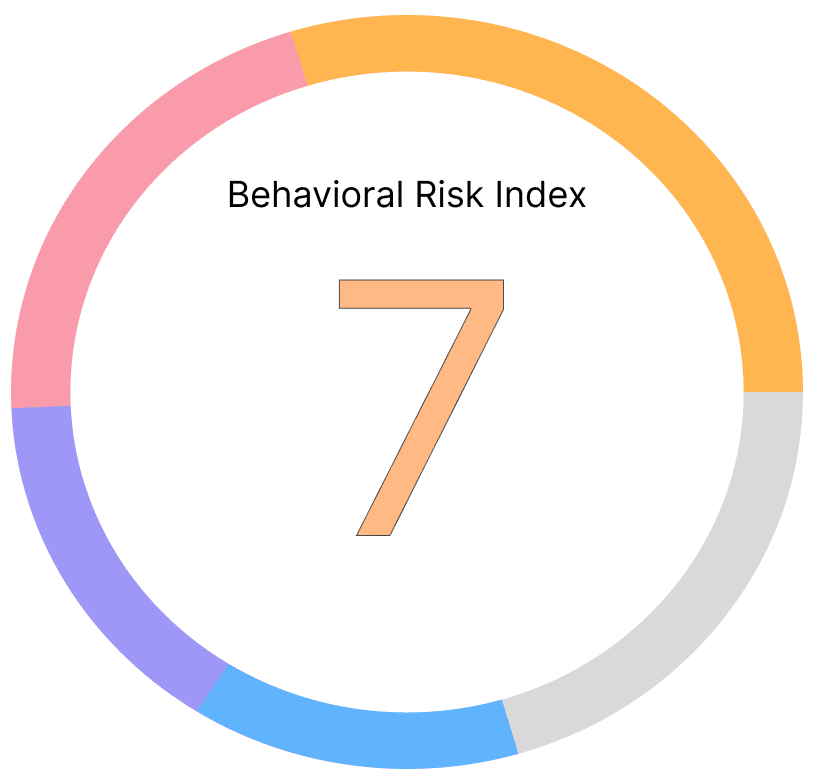

All behavioral factors can be rolled up into a Behavioral Risk Index, a number from 1-10 that indicates how likely an investor is subject to irrational responses. During market turmoil, advisors can prioritize clients with high behavioral risk who need the handholding the most.

“No Shame” – We Are All Human

Sometimes people hesitate to talk about behavioral biases because it feels judgmental. The good news is, it doesn’t have to be.

All of us have various behavioral biases to some extent. Having the awareness is important but we are all human and it is ok to have emotions that may not be perfectly rational.

Use Behavioral Finance To Solve Real Problems

We needed something that would help us systematically identify the investor types and behavioral biases for our clients and prospects.

Andes Wealth stood out as a unique way to not only help us better understand our clients and prospects, but also help our advisors better understand themselves so they could better relate to clients.

Want to learn more? Submit the form to get in touch today.