Personalized Advice Throughout Client Lifecycle

Add Andes to Your Stack

Our Integration Partners

Awards

Patents

Helen Yang, CFA, founder and CEO, has obtained two patents from the US Patent and Trademark Office that cover risk tolerance test, behavioral finance, IPS generator, and deep analytics.

A problem solver and thought leader, Yang received her MBA from the Massachusetts Institute of Technology, and shared the prestigious Harry Markowitz Special Distinction Award in 2011 with Dr. Andrew Lo, who invented the Adaptive Markets Theory.

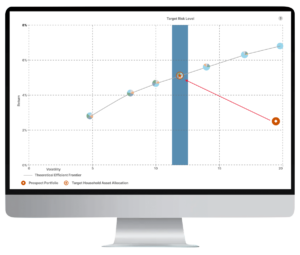

Risk Analytics & Behavioral Finance Solution for Advisors

Protect Aging Clients: A Proactive Approach

Have you ever noticed your client’s cognitive decline but don’t know how to to bring it up?

Just like doctors recommending certain tests for certain ages, you can make it the best practice to use a quick test to establish a cognitive baseline early, and retake it every year.

Clients can see it themselves when declines happen. It is also a great opportunity for you to engage the next generation early to build trust and continuity.

How Does Andes Wealth Help Financial Advisors Succeed?

Convert Prospects

“Andes Wealth is not a marketing tool, but it drives conversations that help a prospect see your investment expertise… to close a higher percentage of prospects.”

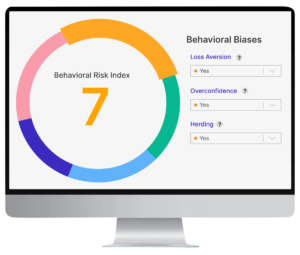

Know-Your-Clients with Behavioral Finance

“It goes beyond traditional risk tolerance measurement to provide a deeper look at a client’s behavioral biases, investment personality, and facilitate a deeper conversation.”

Protect Your Practice

“Andes portfolio decision-making process is defensible in court as actual assessment of what the client wants, needs and can tolerate in difficult markets.”

Want to learn more? Submit the form to get in touch today.