Proposal & Portfolio Analysis

Proposal & Portfolio Analysis

How to Compare Portfolios to Convert Prospects?

If the prospect has an existing portfolio, you can compare it with the proposed asset allocation to see if the risk is aligned, and if it is efficient. The efficient frontier visualization is the perfect tool to look at both.

The pie charts are your models forming an efficient frontier. The star indicates the proposed asset allocation, while the orange circle with the diamond is the prospect’s portfolio. You can see how the risk is not aligned, and the prospect portfolio is not efficient.

When comparing prospect portfolio, 10-year is used by default, although you can also look at any time period for an in-depth analysis.

Can Portfolio Risk Be Captured By a Single Score?

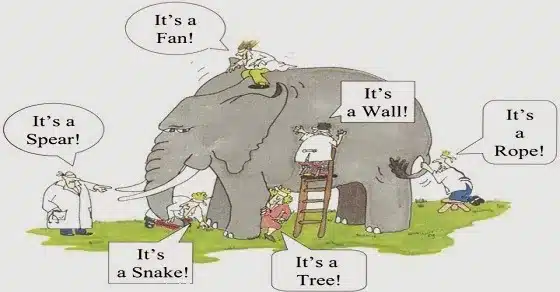

Image: https://medium.com/betterism/the-blind-men-and-the-elephant-596ec8a72a7d

In the parable of The Blind Men and An Elephant, each blind man felt a part of the elephant and they reached completely different conclusions.

Portfolio risk is like an elephant – it can be very different for the short-term and long term, thus can’t be captured by a single score.

Instead, each time period, from 1-month to 30-year, offers an important aspect of the risk picture, and together, they form a complete picture of the elephant.

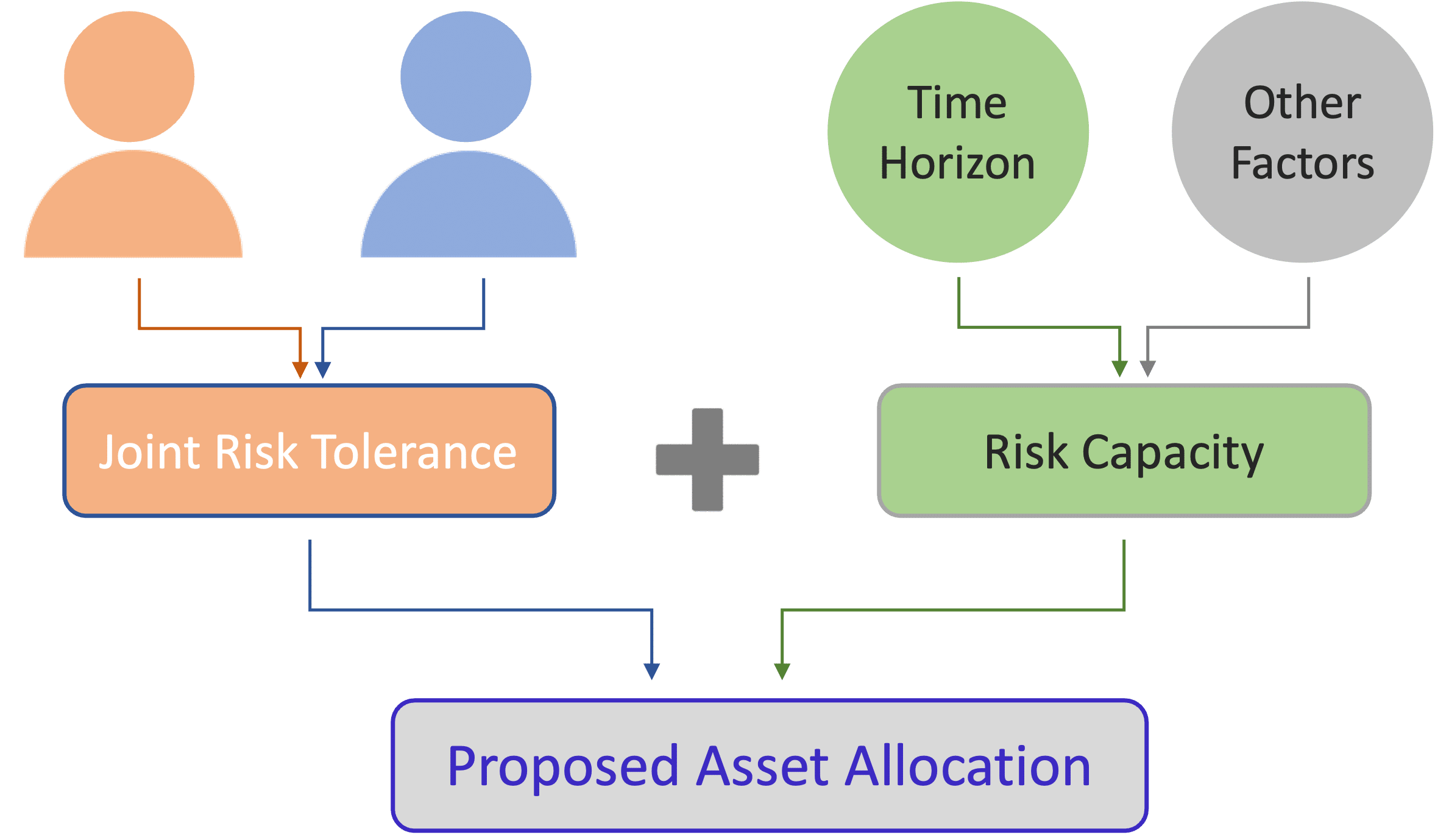

What Drives Investment Proposal Generation?

After risk and behavioral profiling, it is time to generate an investment proposal.

Some systems only consider the client’s risk tolerance, while others, for example, target date funds, only consider time horizon. Both methods are flawed.

The right approach is to combine risk tolerance and risk capacity, which can be proxied by time horizon.

For risk tolerance, it needs to consider both members of the household.

How to Tell a Compelling Long-term Story?

When the clients are suffering during market turmoil, it is important to recognize the acuteness of the pain. You can show them that the short-term risk, which is indeed very high, to tell them that you understand their worries and panic.

Then you can show how their portfolio looks just fine if you look at 5- or 10-year, to give them the assurance.

Combining this with behavioral finance – how our emotions are often influenced by behavioral biases such as loss aversion and the recency bias – advisors can tell a compelling and personalized long-term story.

“Andes is a Swiss army knife of modern portfolio theory data; you can look at the efficient frontier for any time period… in any economic environment. It’s an ongoing instrument to spur dialogue and provide explanations in the face of extreme market conditions.”

-Bob Veres

Your client solutions are best-in-class in our opinion at PEEK WEALTH. What your solutions provide our clients in the manner in which they do is bar none. We are very happy with Andes Wealth!

Want to learn more? Submit the form to get in touch today.